Using Greenlight to Teach Money Management

A few weeks ago, I shared that Chris and I had opened Greenlight accounts for Bean and Gracie as part of our summer of money management practice. I promised that I would report back and let you know how it was going. In a nutshell?

It’s freaking awesome.

I found Greenlight because their ads were filling my Facebook and Instagram feeds, but I didn’t actually know anyone using them, so I was a little hesitant at first. We have been using it for a month now and I am so glad that we found it!

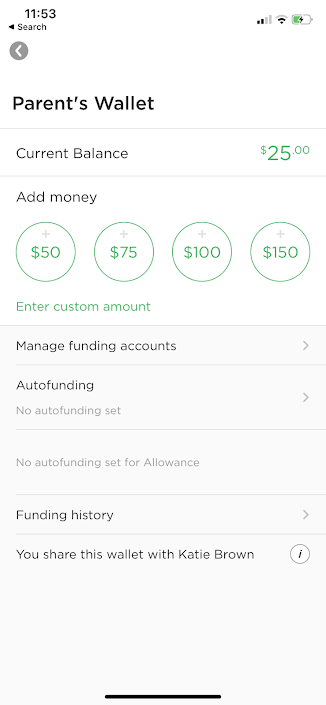

Greenlight is like a checking and savings account in one for your kids. You deposit money from your parent account into their individual accounts. One thing I like is that we have to keep a balance in our parent account. It isn’t actually tied to our bank account, which makes me feel safer. Then, once a week, we have it set up to auto-pay out of our parent account into each of their accounts for their allowance.

Chris and I are set up on the same account, so we both get notices when money is moved either from our parent account to the kids account, or when the kids spend their money on anything. This is the alert I get on my Apple watch. It also pops up as a notification on each of our phones when the kids spend anything.

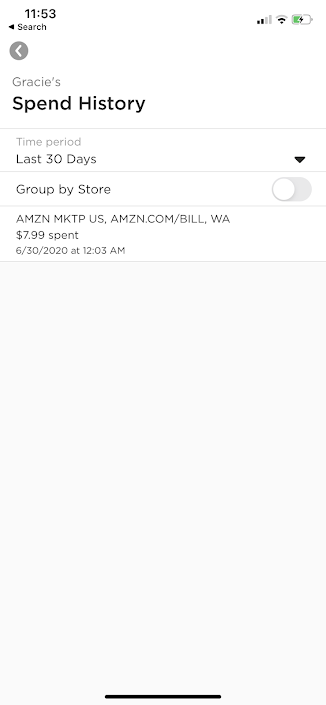

As for the kids, they manage their accounts digitally, as well. Each of them have their own access to their accounts. Bean manages his from his phone and Gracie does her from my iPad. Chris and I also have access to their accounts through the Greenlight app on our phones, too. Nothing happens in their accounts that doesn’t send an alert to us.

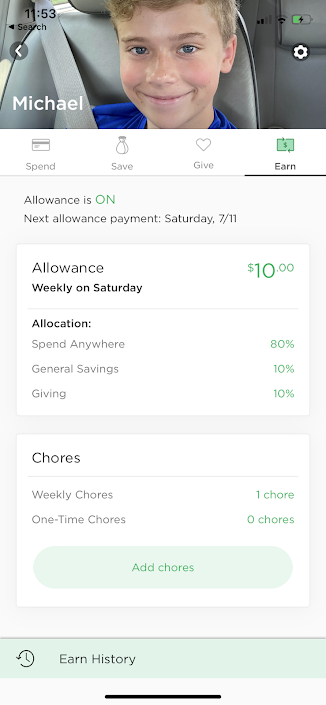

My favorite part about Greenlight (and the ultimate reason we chose to use it) is because you can set up how the money is paid into the kids accounts. We are teaching our kids to spend, save, and give, so we split their allowance payment into percentages that automatically pay out into one of their three accounts. 80% goes into their spend, 10% into their give, and 10% into their savings.

As you can see in the picture above, you CAN choose to have them track chores through Greenlight and pay them based on what they complete. We haven’t really set this up yet because we were just learning how to use the app, but if that feature works like the rest of the app, then it is probably super easy to use.

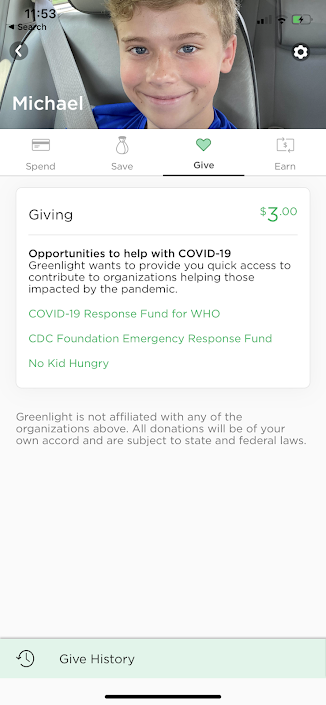

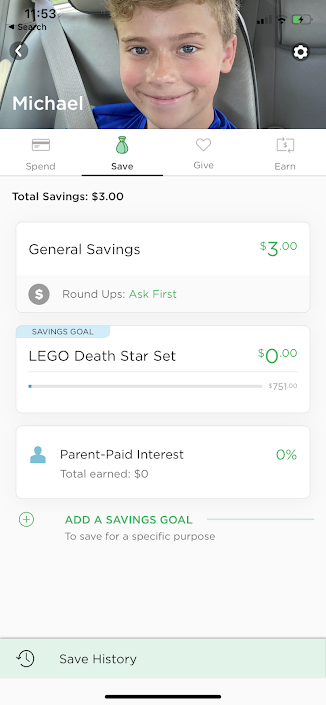

In their “Give” account, they can pay out their balances anywhere that takes a debit card or Greenlight suggests giving accounts that might interest them based on a personality survey they take when they set up their account. We are having our kids save $25 in their “Give” account before we pay it out.

The “Savings” account is another reason we chose this app. The kids not only can save into a general “Save” account, but they can add different accounts to save towards specific items. You can see that Bean has set up to save for the Lego Death Star set (which is $500, so… good luck, kid…). Right now, both of them are focused on saving for a vacation we are getting ready to take next week. We told them that we would match whatever they had in their savings account and that would be their spending money for the trip. When we leave for the trip, we will move the balance from their savings over to spending so they can spend it and we will add in an additional deposit from our parent account that matches it.

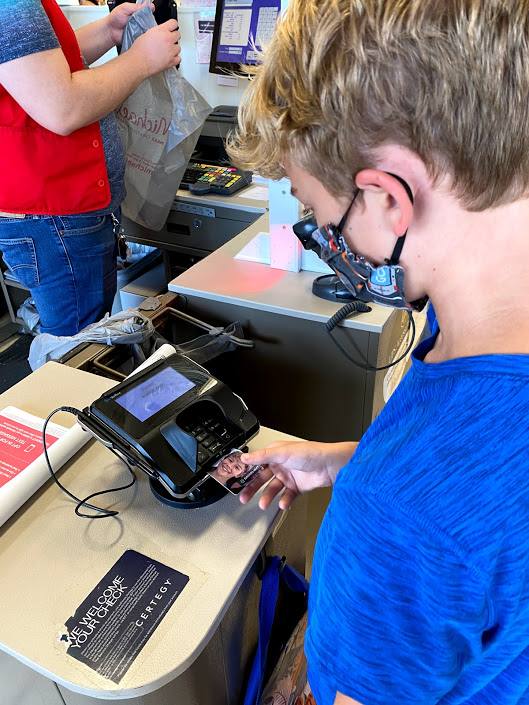

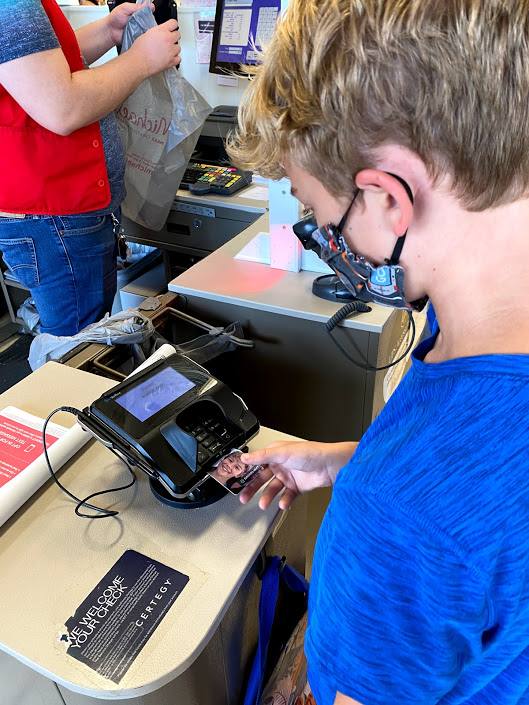

So, here is the final reason we chose Greenlight… The kids get their own debit cards. (sigh) I had mixed feelings about this because Chris and I didn’t have debit cards until we were in high school. But, honestly, everywhere and everyone deals in electronic money now. Cash is hardly ever around, which meant that Chris and I never had allowance on hand to pay out to the kids on Saturdays and so we were always owing them money and then spending it from our account anyway. It was a pain the butt to manage who we owed and how much they had spent of their running balance. Now, they have their own debit cards and it has been so much easier to pay them and for them to have immediate access to their money.

The debit cards only give kids access to their “Spend” account. If they try to spend more than what is in their “Spend” account, the card is declined. This keeps them from being able to overspend or pull from their other accounts when spending.

After a month with these cards, I am 100% a fan. The kids are always checking their balances and planning for their spending now. They carry their wallets with them like responsible humans and they are making better choices with their money because they don’t have that cash burning a hole in their pocket. They actually seem to be much more intentional in their spending than they were when we were using cash allowance.

If you are interested in setting up an account for your kids, use my link here to get started. Full disclosure: Greenlight gives $10 for any referrals, so if you use my link, you are adding to my kiddos vacation spending and they say thank you! Even without the referral, though, I would highly recommend this for kids 3rd grade and up. It has been an excellent and surprisingly helpful part of our money management summer for our kids.

One Comment

Jen

Does it still charge a fee to use? I was using it with my kids over a year ago, but was annoyed at the $5-6 fee I was being charged (monthly? bimonthly? I don’t remember).